Non‑Life Insurance Market in Kosovo 2025: A Growing Market That Also Pays More Claims

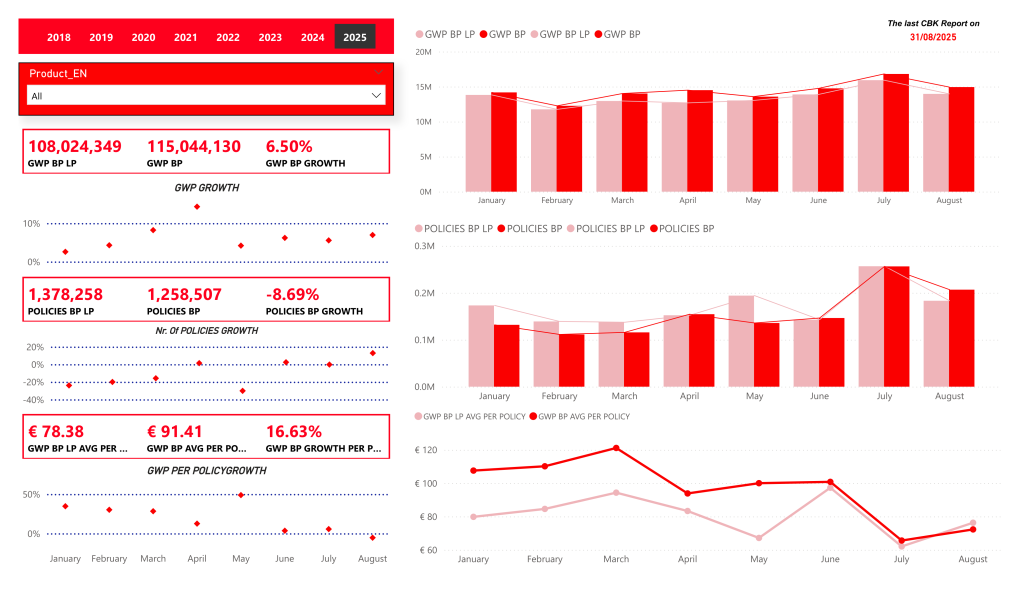

In the first eight months of 2025, Kosovo’s non‑life insurance market continued to expand, reaching €115 million in gross written premiums (GWP) – a 6.5% increase compared to the same period of the previous year.

At the same time, gross paid claims rose sharply to €56.47 million (+19.8%). This indicates a higher market burden in covering claims and a year marked by a greater frequency of compensation requests.

Stable Growth, But With Claim Challenges

According to CBK published data, the market maintains a claims‑to‑premium ratio of around 49%, a higher level than in 2024. The dominant line remains MTPL insurance, accounting for 56.27% of total premiums, meaning that more than half of the market volume still comes from mandatory motor insurance.

Three other segments recorded significant movements:

- Fire and natural forces, with +19.36% growth in premiums and +645% in claims;

- Other property damage, with a staggering +591% in premiums but a sharp −95% decline in claims;

- Goods‑in‑transit, which suffered a notable contraction of −42.6%.

The health insurance line remained stable: +0.32% in premiums, but +12.36% in claims, reflecting more frequent use of health products.

Market Leaders

At company level, Sigal UGA continues to lead with €16.96 million in gross written premiums and a 14.74% market share, reinforcing its leadership position.

Following are:

- Illyria, €14.85 million (+14.5%),

- Scardian, €14.03 million (+8.4%),

- Eurosig, €13.93 million (+8.5%), and

- Elsig, €13.40 million (+8.1%).

The top five companies jointly control over 63% of the market, confirming a high level of competition and concentration. On the other hand, Siguria and Dukagjini registered respective declines of −1.9% and −4.5%

Significant Increase in Claims

Compared to 2024, the total amount of paid claims rose by 19.8%, while the number of claims increased from 148,457 to 153,703. This signals a higher frequency of loss events and a broader distribution of compensation requests.

Companies with the highest claim growth include:

- Sigal UGA (+66.5%),

- Eurosig (+60.3%),

- Dukagjini (+42.6%), and

- Scardian (+21.3%).

Meanwhile, Sigma VIG and SigKos experienced declines of −8.6% and −38.3%, respectively.

By: Alban Humolli

September, 2025